Can Freelancers Claim Home Office Deductions

As more professionals shift to freelancing, the home office has transformed from a makeshift corner into a legitimate workspace. But can freelancers really claim home office deductions without raising red flags from the IRS?

The short answer is yes — if you do it right.

In this guide, we’ll walk you through everything you need to know about claiming home office deductions as a freelancer. We’ll clarify eligibility rules, explain how deductions are calculated, and give real-world examples. Plus, we’ll show you how to maximize your savings without triggering an audit.

What Counts as a Home Office for Freelancers?

Before diving into deductions, you need to know whether your workspace qualifies.

To legally claim the home office deduction, the IRS requires:

- Regular and exclusive use — Your workspace must be used exclusively for business.

- Principal place of business — It must be your main base of operations.

Example: If you use your kitchen table to write blog posts in the morning and eat dinner on it at night, it doesn’t qualify. But if you convert your guest bedroom into a writing studio, you likely qualify.

Learn more about general tax basics in our post: Freelance Tax Basics: What You Need to Know

Two Ways to Calculate the Home Office Deduction

Can Freelancers Claim Home Office Deductions

Can Freelancers Claim Home Office Deductions

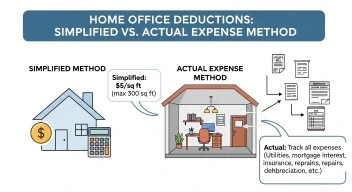

The IRS provides two methods:

1. Simplified Method

- $5 per square foot, up to 300 square feet

- Max deduction: $1,500

This method is easy to use and doesn’t require tracking detailed expenses. It’s ideal if you don’t want to do a lot of math or if your workspace is relatively small.

External resource: IRS Simplified Home Office Deduction

2. Actual Expense Method

You can deduct a portion of actual expenses like:

- Rent or mortgage interest

- Property taxes

- Utilities (electricity, internet)

- Insurance

- Repairs and maintenance

For example, if your home office is 10% of your home’s total square footage, you can deduct 10% of qualifying expenses.

Pro tip: Keep records of utilities, receipts, and square footage. Use an app or spreadsheet to track monthly.

What You Can and Cannot Deduct

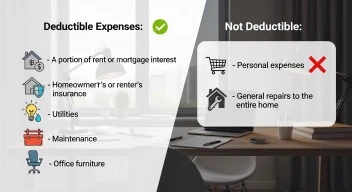

Deductible Expenses:

- A portion of rent or mortgage interest

- Homeowner’s or renter’s insurance (proportional)

- Utilities (electric, water, internet)

- Maintenance (e.g., painting your office wall)

- Office furniture (if used exclusively for business)

Not Deductible:

- Personal expenses (Netflix subscription, your family’s portion of internet use)

- General repairs to the entire home (unless partly allocated)

Read more in our detailed post: 10 Tax-Saving Tips for Freelancers in 2025

Common Misconceptions About Home Office Deductions

Can Freelancers Claim Home Office Deductions

Can Freelancers Claim Home Office Deductions

1. “It’s a Red Flag for an Audit.”

False — if you follow IRS guidelines and document your deductions properly, this is not inherently suspicious.

2. “You have to own your home to qualify.”

No — renters can claim deductions too.

3. “It only applies if I work full-time.”

Wrong again — part-time freelancers can also qualify if the space is used exclusively and regularly for business.

Visit: IRS Home Office Deduction FAQs

Can Freelancers Claim Home Office Deductions

How to Track Your Home Office Expenses

To avoid trouble later, you must track all deductible expenses accurately.

Use tools like:

- QuickBooks Self-Employed

- FreshBooks

- Your own spreadsheet + receipt scanning app

Want a free, simple tracker? Try the Freelance Tax Calculator on our homepage — we’re building tools for freelancers like you!

How This Deduction Impacts Your Taxable Income

Let’s say:

- Annual rent: $24,000

- Home office is 10% of home

- Utilities: $3,000

Your deduction =

10% of (Rent + Utilities) = $2,700

That’s $2,700 off your taxable income — potentially saving hundreds in taxes.

When You Should Use the Simplified Method

Use it if:

- Your office is small (under 300 sq. ft.)

- You don’t want to track expenses

- You prefer simplicity over maximizing deductions

Use actual expenses if:

- You own your home and pay high mortgage interest

- You want to claim a bigger deduction

- You’re already tracking expenses for other deductions

Are There Risks to Claiming This Deduction?

Like all deductions, only claim what you can back up.

Tips to stay safe:

- Take photos of your workspace

- Keep utility bills and rent/mortgage docs

- Avoid exaggeration — IRS can disallow unreasonable claims

For more deduction strategies, check out Top 10 Freelance Tax Deductions You Need to Know in 2025

The Takeaway: Claim It, But Claim It Right

Yes, freelancers can absolutely claim home office deductions — and many should. But doing it correctly matters more than doing it boldly.

Start small if unsure. Use the simplified method first year, then consider switching to actual expenses once you’re tracking better. And most importantly, keep documentation.

Saving hundreds in taxes isn’t out of reach — you just need the right information and a little organization.

Can Freelancers Claim Home Office Deductions

Can Freelancers Claim Home Office Deductions